When you run the numbers for a prospective rental property and compare it to similar properties in the area you’ll find opportunities. You may be able to improve your profit margin, either through charging higher rents or reducing ongoing costs for maintenance and capital reserves.

The first (and most obvious) solution would be to buy the property at a bargain price. A lower price means you need less for the down payment, less for insurance, and possibly change your tax base since tax-es are based partially on the home price. You may succeed with a low-ball offer if the property needs a little TLC; you then invest in a few improvements and increase the rent because it is now more attractive to current or prospective tenants.

Wise real estate investors work with actual numbers, however, not what ifs. The 50% rule of thumb — where funds you set aside for non-mortgage expenses and capital reserves should add up to no more than 50% of gross rent. Your best case is to find a property where you can afford to invest in the right improvements to help you reduce operating costs – and position you to charge a higher rent.

Three Strategies to Lay the Groundwork for a Rent Increase

Before raising rents, you need to make sure your property justifies the higher rent rates. Try these strategies to boost your asking rents.

1. Make Capital Improvements & Repairs

First, it’s essential to understand the difference between capital improvements and repairs. The result may be the same, but each one hits your bottom line differently.

Repairs involve small, often inexpensive fixes that maintain your property in its current condition. Examples include:

-

- Fixing a plumbing leak.

- Repairing a foundation crack.

- Replacing a cabinet door.

- Patching a hole in the wall.

Tenants appreciate repairs and have every right to expect them because such repairs keep the property in the same functional condition as when they first moved in. You can claim these repair expenses for the tax year in which you incur them.

On the other hand, capital improvements are investments you make in the property that increase your rental property’s value or extend its life. These improvements tend to be more labor-intensive and expensive than common repairs. Examples of capital improvements include a new roof, windows, siding, HVAC system, or water heater – or even larger, the addition of a garage. For tax purposes, these improvements must be capitalized and depreciated over several years.

As you consider potential capital improvements on a property, you’ll want to think about both the value you are creating and how any improvements can translate into a rent increase. If you can charge higher rent, you may recover the cost of the improvement sooner. Tenants value capital improvements – like new windows, furnaces, and upgrades to other home systems – especially if the improvements keep their energy bills lower.

The IRS has a tax guide on how to depreciate capital expenses. In most cases, a property owner will claim a small portion of the current year’s expense and then some amount of the remainder in subsequent years according to the depreciation schedule.

2. Add Amenities to the Property

Structural additions such as a new room, bathroom, or garage qualify as capital improvements. Improvements like these also position you to charge higher rent for the property. For example, a recent Rentometer report showed the average rent for a two-bedroom home in Madison, WI was $1,164 for homes with one bathroom, versus $1,589 for similar homes with 1.5 or more bathrooms. That’s $425 more rent per month, just for an extra half bathroom!

You can charge more rent because you’ve increased square footage for living space or made the property more convenient and thus more desirable. Your ownership goals for the property — and the neighborhood in which it’s located — will help you determine if investing in such an amenity makes sense. You don’t want to improve a property unless you are confident it will increase in value. If tenants do not consider the new amenity worth the extra rent, you may be throwing your money down the tubes.

Always do your due diligence when considering amenities to add. Gather details for comparable properties from the same area. See what kinds of amenities they offer. If similar rentals have hardwood floors, granite countertops, and a half bath, consider these changes for your property. However, simple and relatively inexpensive amenity additions might include a laundry facility or window air conditioners. You may not need to invest a lot to charge higher rents — little improvements add up to a more desirable rental overall.

3. Review Comps for the Neighborhood

Suppose your property is one of the “best” in the neighborhood. It features improvements like new cabinets, granite countertops, hardwood floors, and updated lighting fixtures. In that case, you can easily justify a rent that falls at the high end of the range.

With property due diligence, you can determine the right range for your rental rates. Don’t leave money on the table! Check the actual data about area rents to determine what you charge for rent. Otherwise, you may settle into a pattern of low rents. Then when it comes time for a capital improvement or more expensive repair, you may not have the funds to cover the expense. The wise landlord and property owner is someone who keeps close tabs on market rents, maintains the property proactively — and ends up with a solid bottom line.

Any or all of these options can position you to increase rents for your property. When you can make improvements ahead of the curve, you should benefit from reduced costs from general wear and tear. Barring a major system failure, you may go as long as 5, 10, or even 15 years before you need to inject another large amount of capital for an improvement. You’ve reduced overall operating costs, and you can enjoy the savings and profit advantages that higher rents provide.

(article continues below)

Property Improvement Case Study

For a property listed for $100,000, if you can purchase it for $97,000, you’ll come in under the 50% rule of thumb estimate. Install a new furnace, which we’ll estimate at $3,000, and make a few inexpensive cosmetic upgrades — you can now reasonably charge more rent. While you still invest $100,000 overall, you boost your top line with higher rents.

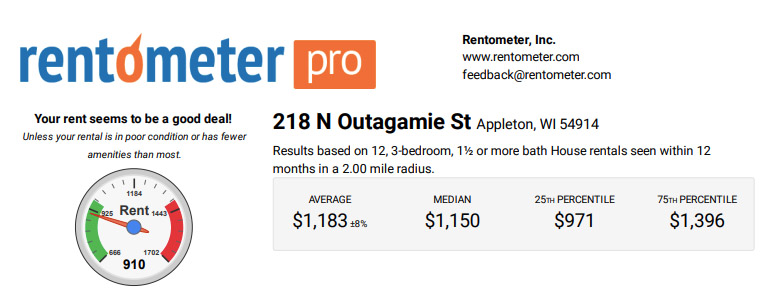

Consider this example property report from Rentometer:

Rented out at Rentometer’s “average” rent level of $1,100/month, this property was actually losing $50 a month when accounting for all the costs. After improvements, it’s a straight path to increase rent to the area’s 75% level for this property. In this example, Rentometer’s rent at the 75th percentile is $1,395 per month, representing an additional income of $295 per month.

*All the amounts in the table are rounded up for clarity.

After improvements, this conservative scenario reflects your new, higher rents but keeps costs for insurance, maintenance, reserves, and mortgage at the same level, to net you $213 per month. Your improvements will add to the property’s base value. Your monthly accruals for maintenance and reserve costs may be higher than you need for an updated property. It still makes long-term sense to prepare and save for potential large expenses. When you need to replace big-ticket items, you’ll avoid the need to borrow or using personal savings to cover them.

How to Estimate Market Rents

Online tools like Rentometer can help you quickly determine if it’s realistic to target a rental rate in the 75th percentile for your area. As you review and analyze different properties, you’ll also start to learn about neighborhoods. You’ll learn where you can charge higher rent if your well-maintained property offers in-demand amenities.

This helps you decide whether investing in capital improvements as a path to higher rents for your property is worth the cost. If the neighborhood supports your hard work and additional investment, you can earn a healthy return.♦

How do you typically add value to your rental units?

More Rental Investing Reads:

About the Author

Rentometer provides market research data for landlords and property managers. They help investors understand their local market and not just what to charge for rents, but whether a market makes sense for investing in the first place.

This article originally appeared on Rentometer.com and is republished here with the author’s permission.

I want to know more about…

The post How to Drive Up Market Rents for Your Properties appeared first on SparkRental.